The European Commission released a series of measures on Tuesday aimed at bolstering its sustainable finance framework, including a new proposal to regulate ESG ratings providers, and the introduction of a new set of criteria for sustainable economic activities under the EU Taxonomy.

The sustainable finance framework is aimed at helping facilitate the flow of capital needed to finance the EU’s sustainability goals, including the ambitions of the European Green Deal, such as reducing net greenhouse gas emissions by at least 55% by 2030 and achieving climate neutrality by 2050.

The Commission estimates that achieving the objectives of the Green Deal will require investments of around €700 billion per year, with the bulk coming from private funding.

The framework’s key building blocks include the EU Taxonomy, rules on disclosures and reporting for companies and investors, and tools such as standards and labels enabling the development of sustainable investment solutions and avoid greenwashing.

Calls to regulate the ESG ratings sector have increased in recent years, as investors increasingly integrate ESG considerations into the investment process, yet the activities and businesses of the providers are generally not covered by markets and securities regulators.

In early 2021, European markets regulator ESMA issued a letter to the European Commission’s financial services coordinator Mairead McGuinness, advising that the current unregulated status of the ESG ratings sector and the resulting lack of transparency posed a potential risk to investors. In July 2021, the Commission launched a new Sustainable Finance Strategy, which included a pledge to take action to improve the reliability, comparability and transparency of ESG ratings, and subsequently asked ESMA to begin examining the market participants.

Under the new proposals, ESG ratings providers will be supervised by ESMA to ensure the quality and reliability of their services, and the providers will be required to use methodologies that are “rigorous, systematic, objective and subject to validation.” The proposals also include organizational requirements to prevent potential conflicts of interest, and transparency rules regarding the methodologies, models and key rating assumptions underlying the provider’s ratings activities.

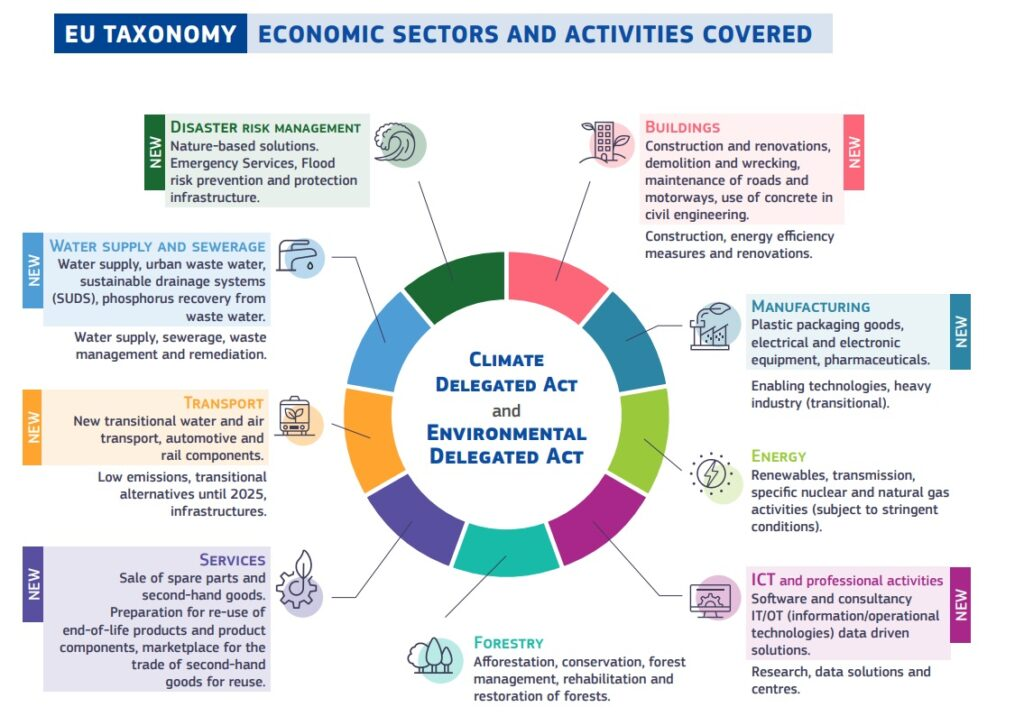

The EU Taxonomy is part of the EU Action Plan on Sustainable Finance, established by the EU Technical Expert Group on Sustainable Finance’s (EU TEG). The taxonomy is a classification system enabling the categorization of economic activities that play key roles in contributing to at least one of six defined environmental objectives, and no significant harm done to the other objectives.

The taxonomy took effect in 2022, beginning with the first two climate objectives. The new criteria introduced today by the Commission significantly expands the taxonomy to include the remaining objectives, which include sustainable use and protection of water and marine resources, transition to a circular economy, pollution prevention and control, and protection and restoration of biodiversity and ecosystem.

Mairead McGuinness, Commissioner for Financial Services, Financial Stability and Capital Markets, said:

“Today we are taking steps to further develop the EU Taxonomy. And we are bringing more transparency and integrity to the market by introducing rules on the operations of ESG rating agencies. Enhancing the usability and coherence of the sustainable finance framework will be our key priority.”

Source: https://www.esgtoday.com/eu-commission-releases-proposed-regulation-of-esg-ratings-providers/